Earn More.

Everywhere.

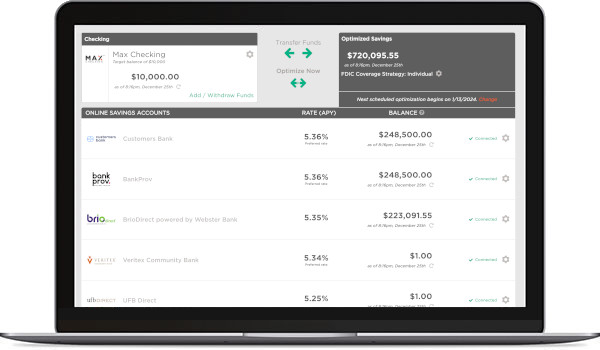

Seamlessly link your existing checking, savings, and brokerage accounts to Max to earn preferred rates on your cash, no matter where you bank or invest.

Link all your accounts to Max Checking

- 0.20% APY, FDIC-insured1

- Free: No minimums or monthly fees1

- Same-day ACH funds transfers2

- Unlimited free domestic wire transfers3

- Earn Max membership rebates

- Opens in 60 seconds

Max Checking is powered by Customers Bank,

Member FDIC #34444

Seamlessly Integrates with Max for Access to High-Yield Savings Accounts

- Market-leading rates of up to 5.41% APY on savings1

- Earn the highest yield each month, even as rates change

- Increased FDIC insurance coverage, up to $8 million per couple

- Links to checking, savings, and brokerage accounts at thousands of financial institutions nationwide

Is Max Checking Right for Me?

Earn more with Max by linking your existing checking account or opening a new Max Checking account in 60 seconds!

Link Your ExistingChecking or Brokerage Account |

Use a NewMax Checking Account |

|

|---|---|---|

| Earn preferred rates on savings, up to 5.41% APY1 | ||

| Open new high-yielding savings accounts in as little as 60 seconds | ||

| Increase FDIC insurance coverage — up to $8 million per couple | ||

| Link one checking account

Max will sweep funds to/from savings to help you

maximize yield while maintaining a target checking account

balance

|

||

| Link multiple checking, savings, and brokerage accounts to

Max Checking

Transfer in a specific amount of cash and Max will

help you allocate it to higher-yielding savings accounts to

help you maximize yield.

|

||

| Earn preferred rate on checking of 0.20% APY1 | ||

| Same-day ACH funds transfers2 | ||

| Free domestic wire transfers3 | ||

| Earn rebates on Max membership fees

Keep at least $10,000 in Max Checking and you’ll receive a

Max membership rebate of up to $25 each quarter (up to

$100 per year). Keep at least $20,000 in Max Checking and

you’ll save up to $50 per quarter (up to $200 per year).

|

||

| Supported banks | Compatible with checking accounts at 18 of the largest banks and brokerage firms in the country |

Fund your account from your choice of thousands of financial institutions nationwide |

Ready to Earn More?

Start with “Max Checking” as your checking account when enrolling for Max.

Get StartedExisting Max members: Click on the gear icon next to your existing checking account, de-link that account, and follow the prompts to add Max Checking.

Questions?

What is Max Checking?

Max Checking is an integrated checking account that opens in as

little as 60 seconds and helps connect your existing bank and

brokerage accounts to Max’s proprietary network of

high-yield savings accounts. Max Checking offers a yield of

0.20% APY1, same-day ACH

transfers2, free domestic wire transfers3,

and no monthly fee.

Why open a Max Checking account?

Max Checking enables you to link Max’s intelligent cash

management solution to your choice of checking, savings, and

brokerage accounts at thousands of financial institutions

nationwide. Now you can earn dramatically more on all your cash no

matter where you bank or invest.

Does it work with my existing banks?

Link any combination of bank and brokerage accounts and transfer

funds to/from Max Checking with one click. Tell Max how

much to keep in Max Checking and you can allocate all funds in

excess of your target balance to your higher-yielding online

savings accounts each month, so you can earn more.

How much does it cost?

Max Checking is available to Max members at no

additional cost. There are no monthly fees and no minimum balance

requirements associated with the Max Checking account.

Are there other benefits?

Keep at least $10,000 in Max Checking and you’ll receive a

Max membership rebate of up to $25 each quarter (up to

$100 per year). Keep at least $20,000 in Max Checking and

you’ll save up to $50 per quarter (up to $200 per year).

How does Max benefit?

Max Checking enables Max to serve more people by

linking to more financial institutions. Max does not earn

referral fees, commissions, spread, float, or interchange fees

from our banking partner. Max Checking is offered solely for

your convenience, free from conflicts of interest — precisely

what you’d expect from Max.

- Annual Percentage Yield (APY) accurate as of 7/27/2024. Minimum amount to open a Max Checking account is $0.00. Rate of 0.20% applies to entire balance. Rates may change after account is opened. Fees may reduce earnings. FDIC-insured up to at least $250,000 per depositor.

- Funds transfers to/from Max Checking can be completed via same-day ACH as long as they are requested prior to 10:00am ET. ACH transfers are subject to an initial bank hold of up to 10 days before funds will be available to transfer.

- Fees will be waived for all domestic inbound and outbound wire transfers to/from Max Checking.