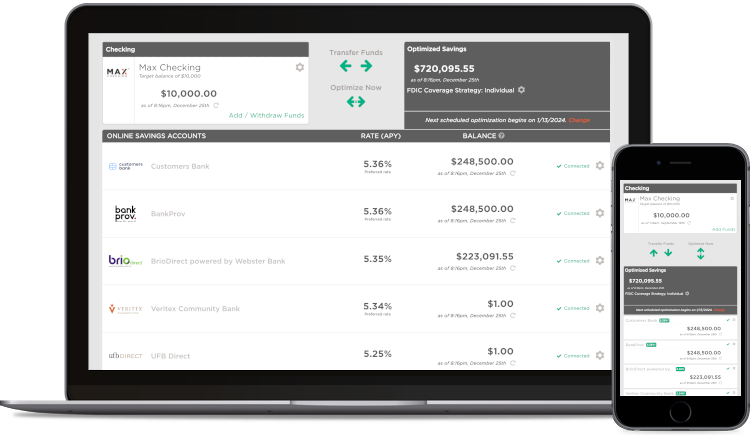

Will my clients’ funds stay in their own FDIC-insured bank accounts?

Yes! Max is not a bank or broker, is not affiliated with any bank or broker, and never takes custody of your clients’ funds, so all funds remain held directly by your clients in their own bank accounts. Max helps clients earn more by proposing to your clients how to spread their cash across multiple higher-yielding online savings accounts, boosting yield and FDIC insurance coverage. The Max Common Application makes it easy for your clients to open new high-yield savings accounts in minutes by filling out a single online form. Your clients retain full access to and control of their funds, with same-day liquidity outside of Max if needed.